First steps of strategic product research at Glovo by UXR & Data

✏️ Illustrations credits to Ivan Mesaroš / Available on Blush

From Spotify, all the way to Microsoft, Booking.com and many more, the leveraging of multidisciplinary teams to conduct product research seems THE WAY to achieve more actionable, comprehensive insights providing a higher likelihood of making informed (and accurate) decisions. This tends to involve both profiles with qualitative research skillset like UX Researchers and quantitative research experts like Product/Data Analysts, BI engineers.

Even if you know where you want to get, looking up to the top of the mountain from a place that is not as mature, staffed and prepared as these Tech giants, makes the launch of such an endeavour pretty uncertain, and hard to frame.

So, how can you start elevating your strategic research practice if you are NOT Spotify? How can you bring UX Researchers and Data folks to act like ONE team?

In this article, I’ll introduce my experience — including challenges and learnings— when setting up the Customer Insights Core, a joint pilot effort by UXR and Data, which represents the very first approach to strategic product research within Glovo. I hope it can serve as food for thought when setting up a similar initiative within your professional context!

Why is the UXR <> Data synergy so important?

UXR & Data are two sides of the same coin, two halves of the same apple. Can you imagine having the power to understand problems and spot opportunities for your business? Well, with UXR & Data together, this is possible through a combination of both statistics, numbers, and trends to size them (Data) as well as a rigorous understanding of users’ emotions, perceptions and mental models behind those, to act upon them (UXR).

Bringing together UX Research and Data can allow you to generate actionable insights comprehensive of both the WHAT dimension (quantitative) and WHY dimension (qualitative) to better inform well-rounded decisions.

Strategic vs Tactical Research

Before jumping any further, let’s outline the differences between Strategic and Tactical Research.

Strategic insights inform the goals and future-facing opportunities for the business.

Example: X% of customers are risk-averse and keep ordering from stores recommended by friends & family because that increases their confidence and sense of validation. #innovation #companyvision #bigpicture #long-term

Tactical insights focus on the product & design implementations to get there.

Example: The social proofing tag was well received by risk-averse customers, however, users would also expect to click on it and see reviews to increase confidence towards novelty. #validation #features #urgency #short-term

You might wonder now, what’s the most important of the two approaches — strategic or tactical research? For a business to succeed you need both – only combined can they unleash their full potential as equal forces complementing each other.

Customer Insights Core pilot

Why

When I first joined Glovo about 2 years ago, UXR and Product Analytics worked with an Agency Model where they were serving product teams independently and on-demand. Very soon after I joined, we piloted the Embedded Model where UX Researchers and Product Analysts got integrated into product teams, working in a multidisciplinary set-up with Product Managers, Engineers, and Product designers.

Over time though, the Embedded Model set-up (alone) was not triggering the impact and influence we wanted UXR and Data to drive in product strategy, there was some untapped potential yet to maximise.

So, what was still missing? What were the limitations we encountered?

- Exclusive focus on tactical research only — as historical baggage from a startup mindset used to executive extremely fast and short-term

- Low integration between UXR <> Data teams, and weak mutual awareness of each other’s skillset

- Successful strategic research case studies out there pointed to the value and potential yet to be uncovered in Glovo.

How

To address the limitations above, we then gradually shifted to a Hybrid Model with 1) an Embedded Model at a Group level, where product teams touching upon the same portion of the customer experience share the same UX Research and Data resources and 2) side by side, we launched a Core Model pilot.

The Core Model is a satellite, centralised team of UX Researchers and Product Analysts, which we called ‘Customer Insights Core’, EXCLUSIVELY dedicated to strategic research, uncovering overarching insights that have transversal benefits for all product teams.

First pilot details:

- 1 UX Researcher and 1 Product Analyst are dedicated, with the UXR Manager and Data Manager overseeing the effort

- MVP mindset: Part-time commitment, about 30% of weekly time

- 6 months duration, given the foundational/explorational nature of the investigation and limited commitment of contributors

- Merged workflow project on ‘Personalisation’*.

*What was the project about? We aimed to define the intersection of a ‘customer mindset’ and a ‘customer segment’ to understand not only what our customers do but why they do it too.

*Why this topic? We aimed at ‘merging’ already existing, independent work that UXR and Data had generated via separate workstreams on the same theme, respectively (Segmentation efforts by Data and Mindsets efforts by UXR)

Challenges & learnings from the first pilot

Challenge 1: ‘Merged’ project set-up

Funnily enough, the first setback was the nature of this merged workflow itself. After looking like a promising, very logical choice, it turned out to be a big limitation later down the line. Why you might wonder?

- First of all, existing biases developed during our prior activities in this area ended up constraining the joint approach that we would come to take together.

- Also, we realised that when working independently, we had missed opportunities on previous outputs that slowed us down.

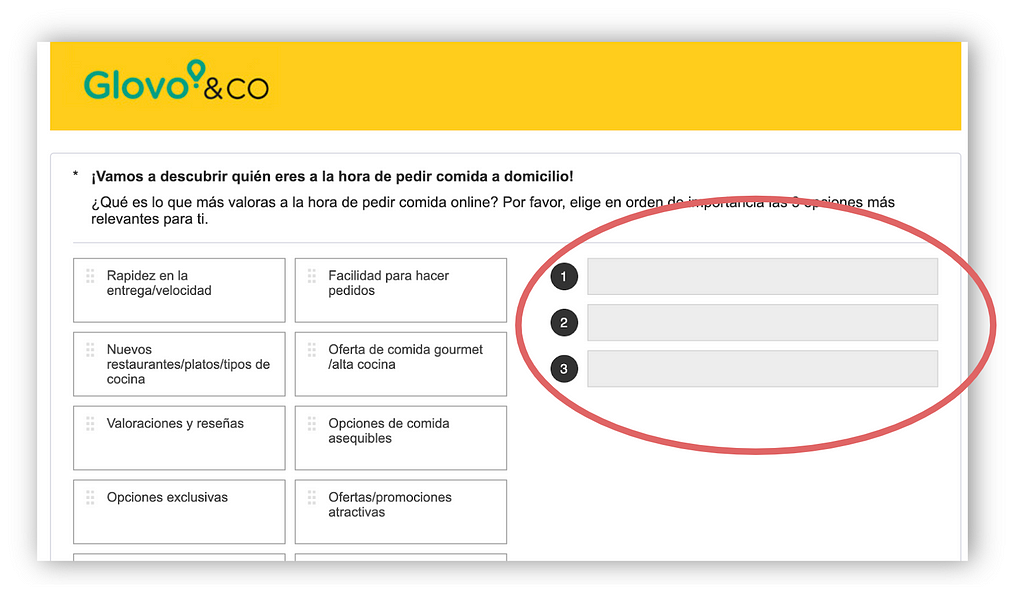

Example: In the survey above independently crafted by UXR, users were asked to rank 3 options by dragging them on the placeholders. This way though, Product Analytics was missing how differently on a scale the options were perceived by customers. If UXR and Data would have crafted this survey TOGETHER from the start, a 1/5 or 1/7 scale would have been selected as a better way of asking that question, for greater accuracy and minimising the assumption space.

Tips

- Prioritise ‘Coupled’ workflow projects, to start diving into a challenge together from day 1, jointly involved at every step

- Craft research artefacts together to cross-pollinate on the best approach to ease mixed-methods analysis

- Shadowing each other along the process. On one hand, PAs shadow user sessions to see the craft of UXR and the qualitative data that emerges, on the other hand, UXRs attend WIP data analysis sessions to ask different questions about the quantitative data

Challenge 2: Product involvement

The second challenge was around the involvement of Product folks. You might wonder, how much or how little should I involve Product stakeholders in such an effort, to make sure we don’t duplicate the dynamics of an Embedded Model twice? In our case:

- The first pilot lacked a clear Product point of contact responsible and accountable for overseeing the initiative

- That meant struggling with building buy-in and pivoting fast enough for greater actionability and stakeholders’ relevance.

Example: In our first final presentation the insights we shared were valuable, but they were perceived as too high level. If we had a product member involved, we could have anticipated this feedback early on and adjusted for relevance.

Tips

- Establish a rotation framework to have a dedicated Product point of contact, which can vary depending on the project scope/theme

- Set weekly ceremonies for WIP sharing & feedback, to craft stronger product narratives

- Plan in advance a Mid-way presentation as a moment to pause and actively seek feedback from your stakeholders’ network, as it is a great way to ensure relevance.

Challenge 3: Hypotheses & storytelling

Our main hypothesis – the core one the study was built on – got invalidated as we progressed. And the researcher in you could argue: that’s per se an insight, right? It is, indeed an equally valuable learning, but:

- During the presentation of results, we based our storytelling around proving hypotheses right (or not) rather than answering research questions, and in the eyes of our stakeholders this created a negative perception that undervalued the topic

- We didn’t focus enough on the risks and pros and cons of multiple mixed methods approaches to assess trade-offs.

💡 Tips

- Run a ‘pre-mortem’ exercise at the beginning of the project as a scoping session, to clarify what you know and what you don’t, taking into account the different scenarios that might emerge

- Plan co-creation sessions and brainstorms around the challenges as a way to get unstuck and progress together jointly

- Align on a quality process for strategic investigations and which milestones allow for achieving successful outputs, helping to manage expectations with all stakeholders involved.

Example: We introduced Dissemination Sessions within our quality process, as a way to ensure dedicated space and time for ideation with the entire team for greater actionability of the research results.

Conclusion

“No matter where you find yourself today, the important thing is to begin. Take that first step to bring UX research and Data science out of their silos.”

And taking the first step for you might also mean simply getting to know each other on a human level first. Like we did cooking paella together in our first UXR <> PA team building!

Also, remember that what works for mature organisations like Spotify might not work for you, and that’s okay. Approach pilots with an MVP mindset and iterate till it works well for YOU and your organisation’s specific needs.

And last, continuously ask yourself throughout the process: How can this output be actionable for the product strategy? How could this tangibly be leveraged in my organisation? If you keep actionability at top of your mind, people around you will start seeing the value such a partnership can unleash. ❤

And by the way, we are hiring! If you think Glovo might be your next challenge, check out our Careers page or Linkedin. ✨

I’m a UX Research Manager who loves investigating people’s needs and behaviours to shape meaningful experiences that put them at the centre. If you have feedback to share, feel free to say hello 👋🏽

How to kick off strategic research if you are NOT Spotify? was originally published in UX Collective on Medium, where people are continuing the conversation by highlighting and responding to this story.