What we’ve been learning while trying to solve a challenging problem and make borrowing work for everyone

The Lending business is hard. Same as banking, it has been historically frustrating to borrow money — loans, overdrafts, credit cards… Fees are not transparent, the price you see on comparison websites isn’t the price you get, most lenders will “punish” you for paying back early, with extra charges — to name a few pain points.

Monzo’s here to make money work for everyone, and credit is a big part of people’s financial lives. We’re really excited to bring our mission to the borrowing world. And, of course, we’ll make money from loans — which will help us become a sustainable business in the long run, without charging unfair fees or acting without the customer at the heart of our decisions.

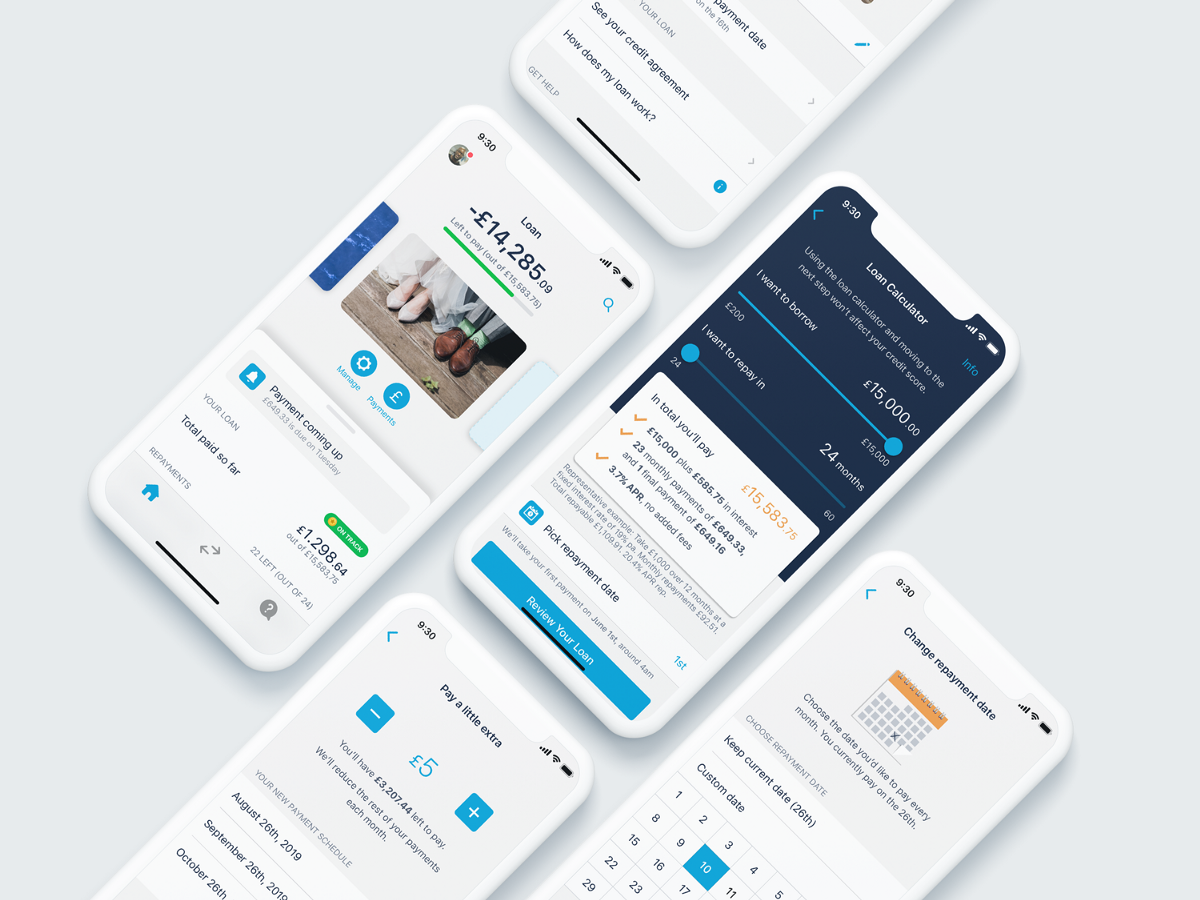

For the past year or so, we’ve been building our Lending platform. We started really small, as always, by deep diving into our customer needs and taking a very iterative approach. We started with overdrafts, providing a “cushion” for customers who ran out of money on their accounts, with an easy to understand fixed fee, letting them know when they’re running low and helping them get back on track if needed. Then we introduced a feature called Spread the cost, which was an “upside-down” kind of loan: if you are eligible and have spent from £200 to £1,000 on a certain transaction, we’d ask you if you’d like to spread the cost of that transaction in 3, 6 or 12 months, with again, an easy to understand and free of jargon experience. Today we’re offering personal loans of up to £15,000 to eligible customers, and we’re growing fast.

I’ve been working on loans specifically for some time now, and here are some of the key learnings while designing a better borrowing experience:

There are cemented mental models around credit

Especially when it comes to loans. Some people are averse to the idea completely. This is often because of previous bad experiences of their own, or relatives. It doesn’t matter how well you build your product, some people just don’t want to use it.

Give people what they need

People want flexibility, they want to feel in control of their debt. They want to be able to repay early with no extra charges, change their repayment dates, the loan length or loan amount. Most people feel quite optimistic about their life situation, so they want reassurance that if their circumstances change, they’ll be able to clear their debt with no penalties.

Celebrate milestones

Taking out a loan is a huge deal and it can cause a lot of stress if you start missing payments. We set reminders to help our customers never miss them, and we also celebrate when they’re on track paying it off.

Helping people in the time of financial difficulty can be a great way to build trust and loyalty with customers. We’ve learnt that celebrating when they’re on track can also boost good behaviour and get our customers engaged.

We want to ensure that if anything goes wrong, we’ve got our customer’s backs.

Don’t take anything for granted

There are thousands of reasons why people might be taking a loan. It could be for something aspirational and exciting, like a big holiday, a wedding, a new car or education. It could also be an emergency or something they couldn’t have predicted, like a boiler or a car broken. But it could also be a change of life circumstances. Maybe they lost their jobs and now need some money to cover bills, or a relative might need serious medical treatment, where there’s a lot of time pressure and so on. We take all these scenarios in consideration through the whole experience, to provide reassurance and clarity.

Most importantly, we want to ensure that if anything goes wrong, we’ve got our customer’s backs. Human customer service is one of Monzo’s key attributes and it’s not different with Lending. We have great people on customer operations and a whole team focusing on financial difficulties and vulnerable customers, and we work very close together.

Speak human language

APR? What is that? Annual percentage rate, a lovely thing. APR is complex and whether you like it or not, it will be there. And if like myself, you never worked in Lending or finance before, you might want to build a good relationship with people who can help you understand the basics, and keep them close. The calculations are not that simple to understand, but you don’t need to be an expert either. Lending is heavily regulated and we need to be compliant. Our goal is to speak human language, even when it gets technical.

People don’t read things

Not a big surprise here, but they really don’t. So we write plain English, we’re straight forward and we emphasise all critical information to ensure our customers know exactly what they’re signing up for. We also show them a summary of the loan they’ve chosen, with a checklist of all the important bits and we allow them to make changes before moving forward, so when they reach their credit agreement and the hard credit checks, they’ll feel confident and informed.

Our goal is to speak human language, even when it gets technical.

Friction is good

Designers will always strive for straight-forwardness, speed and simplicity. However, in Lending, you might want to reconsider. Our loans flow has always been incredibly smooth, but during some of our user testing sessions, we learned that many people felt it might be “too easy”, and that can be scary. You might not want to offer people a loan in a couple of taps, but you still can keep it simple, of course.

Lending is not evil

We believe that borrowing is one way to help our customers solve a problem or achieve a goal. Credit allows growth and we offer this tool to our customers as part of our services as a bank, if they believe that’s the right thing for them.

If done right, borrowing can be a great way to build up your credit score. Demonstrating that you can borrow and pay back on time will allow you to get better rates on future loans or a mortgage. Try framing the borrowing experience into something more positive, as long as it’s not misleading.

If done right, borrowing can be a great way to build up your credit score. Demonstrating that you can borrow and pay back on time will allow you to get better rates on future loans or a mortgage.

People worry about credit checks

It’s important to be very clear about when you’re going to make a “hard” check on people’s credit files. Taking a loan is a big commitment, and it will have an impact on people’s score, so you want to make sure this is clear and visible during the process, as some people might feel too afraid of moving forward if there’s uncertainty around this.

We believe there’s a lot we can do to improve the Lending space and to make borrowing work for everyone. One that excites me is financial health and the education around it: helping people understand how each of these credit options really work, the differences between them, and which might be the most suitable solution to solve a problem or achieve a goal.

We also want to be a hub for people’s financial lives, we want to give everyone full visibility and control of their finances (because that’s how it’s supposed to be!). We want them to come to Monzo every time they have a question about their money and we want to be well equipped to help our customers make informed decisions.

❤️

Want to know more about how we’re lending? Check out our principles 👈

Please share some love if you enjoyed the read! 👏